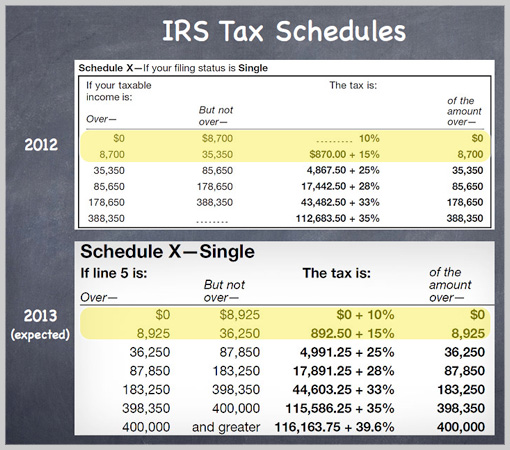

This yellow highlighted example in the tax schedules for 2012 and 2013 will help explain how basing tax rates on the Chained CPI would increase your taxes.

o In 2012, you paid 10 percent of your first $8,700 of taxable income before the next-higher rate (15 percent) kicked in.

o Adjusting for inflation using the CPI scale currently in use (CPI-U), in 2013 you would pay 10 percent on income up to $8,925 before the 15 percent rate kicks in. In other words, the 10 percent tax bracket has expanded.

o If the Chained CPI is used instead of the larger CPI-U, the bracket threshold still would rise above the original $8,700, but not as high as the new $8,925 amount. So any income above that new amount would be taxed at 15 percent, rather than 10 percent.

o If you look beyond the highlighted portion, you'll see how the difference would continue throughout the higher brackets also.

o Adjusting for inflation using the CPI scale currently in use (CPI-U), in 2013 you would pay 10 percent on income up to $8,925 before the 15 percent rate kicks in. In other words, the 10 percent tax bracket has expanded.

o If the Chained CPI is used instead of the larger CPI-U, the bracket threshold still would rise above the original $8,700, but not as high as the new $8,925 amount. So any income above that new amount would be taxed at 15 percent, rather than 10 percent.

o If you look beyond the highlighted portion, you'll see how the difference would continue throughout the higher brackets also.